Younger generations not deterred by “Buy Now Pay Later” despite inflation

The inflationary economic environment does not appear to have discouraged a percentage of Millennials and Generation Z from “Buy Now Pay Later” (BNPL). In a survey conducted on consumers, just over 51% indicated that they did not want additional debt in an inflationary environment. However, 41% of those 18 to 35, and 12% of those over 55, responded that they would likely use these services.

From Fox Business:

However, 41% of those between the ages of 18 and 34 said they’d likely use BNPL services for household purchases. That’s compared to just 12% of older Americans, aged 55 and up, who said they’d be willing to do the same.

“Of the group that has used BNPL, 25% are already planning to use the service to help pay for household essentials that have risen in cost as a result of inflation,” the survey stated.

Younger generation taking more risks with BNPL, Trustpilot says

BNPL providers — including popular providers like Affirm, Klarna and Paypal — partner with retailers to allow shoppers to split the cost of their online purchases into multiple installments at checkout. These interest-free payments are then generally due within a few weeks after the time of purchase. Missed payments, though, can result in late fees and other penalties.

Trustpilot’s survey shows that younger generations are more likely use these BNPL options despite potential pitfalls, like fraud. Specifically, research from fraud prevention company Callsign found that 14% of consumers surveyed have fallen victim to fraud by way of BNPL — this occurred by signing up for fake accounts accidentally, getting hacked and not changing an account password.

When it comes to both luxury and essential purchases, those of younger ages are more likely to take advantage of BNPL to afford them. The survey found that 45% of consumers between the ages of 18 and 34 were likely to use such services for basic essentials, and 54% would for luxury items. For those between the ages of 34 and 54, those results were 33% and 38%, respectively. Finally, for people aged 55 and up, the results were 16% and 24%.

Fox Business has additional information on this survey.

Category: Economy

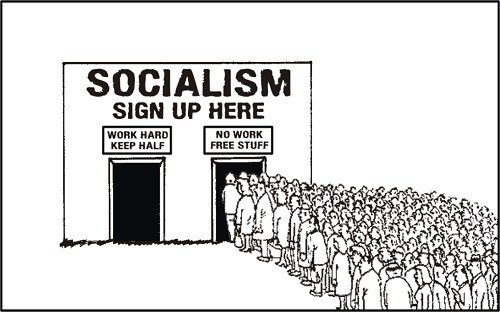

The same generation that complains about tuition debt, now wants to increase their debt load. Obviously, classes in economics are missing in their curriculum. What could go wrong?

This is going to bite them big time. Then they’ll look for a politician to “save” them from their own stupidity, becoming hopeless slaves in the end.

Kids, this ain’t changed:

Free candy so how about The Elchords waxing the song “Peppermint Stick” 1957 on the Good label. Nice jump.

I think some of this will be a self-fixing problem.

(full disclosure: I hate these companies, both on moral and fiscal grounds, I hold no direct shares)

As their stock price tanks due to delinquencies and margins going to shit, the cost of borrowing goes up, their credit req for lending tightens, etc, etc. This fire puts itself out.

The real litmus test for the durability for these companies will be: if/when the economy falls apart, will the Fed bail them out. (Mittens Romney will bend on this for his Bain Boys)

I’m of the mindset that usury is a capital offense, but I’ll moderate to flogging.

(below is Affirm’s YTD performance, down ~76%. Good)

With you 1,000% Roh.

As the saying goes, “Something that can’t endure, won’t.”

At some point, the defaults will overwhelm the lenders (again) and they’ll come to suck at the government tit. We just need to make sure that the tit is dry. Possibly Buttigiegs?

I see also that GenZ wants higher pay, doesn’t want to work in offices, wants shorter work weeks, and most plan to switch jobs within two years. Sound like optimal employees to me.

Help wanted signs are everywhere. Nobody wants a job though.

We have created a generation of stupid, lazy children that expect the rest of us to support them for life.

D-i-L was telling of a convo she was in, where the folks with the help-wanted signs are having problems just getting applications.

One participant told that they’d have 20 applications, 7 show up for the interview, accept all 7 and only 4 take the job.

For unemployment pay, they just have to apply for a certain number of jobs each week.

And there you have it.

GB,

I remember when I was on Unemployment Insurance, yep, the All Knowing State said that You Must Make A Certain Number of Job Applications Weekly To Receive The Weekly Largesse. But at this time it was the other way around. I’d make any number of applications, send out resumes (electronically), and get few to none replies. Lather, rinse, repeat, until I would finally receive one reply that would hire me.

Da, comrade, is whole plan! Personal responsibility and effort is “racist,” no?

We are currently stuck with a bumper crop of snowflakes who have gone eyeballs-deep in debt getting worthless degrees like Gender Studies who think that precious Degree automatically entitles them to a six-digit salary, keys to the Executive Washroom and a posh house in Country Club Hills, they’re the ones wanting everyone else to bail them out of the consequences from their own shitty decisions!

I can hear the cries already. “We’re drowning in debt!!! Government must pay for it!!!”

As George Thorough(ly)good and The Destroyers so eloquently put it…”Get a haircut and get a real job…”

What’s amazing to me after 2006-08 housing debacle is that there are STILL people out there who think doing an ARM is a good idea.

And worse still, there are mortgage brokers out there pushing them.